Thinking that machines are a minor investment decision for businesses is a misconception. Running a business without the right machines is tough. Be it manufacturing, healthcare, or construction, machines may help you deliver your work faster. But new equipment is expensive. Most MSMEs don’t have the extra cash to buy everything upfront. That’s where machinery funding helps.

A reliable financial advisory firm provides MSMEs with the support they need to acquire essential machinery, without waiting or putting pressure on their working capital. Here are the types offered by reliable funding advisory firms.

Domestic Equipment for MSMEs

Many small and mid-sized businesses in India rely on equipment made locally. These machines are easier to maintain and replace. But even domestic machines come with a cost that not every MSME can manage alone. Businesses risk production delays or missed deadlines without timely help.

Capstone offers unsecured business loan for MSME units to help buy local machines. Companies don’t have to postpone plans or use outdated tools with professional help. Rather than that, they can move forward with new equipment that boosts efficiency while lowering repair expenses.

Imported Tools for Production

Some industries need machines from outside India. These imported tools often give better speed, accuracy, or automation. But they cost more and can be harder to buy without support.

If you’re looking to bring in advanced tools, Capstone can help. The company makes machinery funding simple. You don’t need to wait for months to gather the full amount. With smart finance, even an unsecured business loan for MSME can support your equipment upgrade.

Medical Devices

Hospitals and clinics also face cost issues when they want to upgrade or add equipment. Diagnostic machines, surgical tools, and even patient monitors cost lakhs. Small and mid-size facilities cannot always afford these upgrades without support. This affects service quality and patient care.

A reliable advisory firm provides funding for both movable and fixed medical equipment. These loans cover purchase, setup, and even some related services. Some of the equipment that can be funded includes:

- X-ray and CT scan machines

- Dental chairs and surgical tools

- Dialysis and ICU equipment

- Physiotherapy machines

- Lab testing devices

Clinics can serve more patients without compromising on care with the right types of working capital. Quick approvals and sector knowledge help in choosing the right loan plan. This also saves the hospital from using general-purpose loans at higher interest rates.

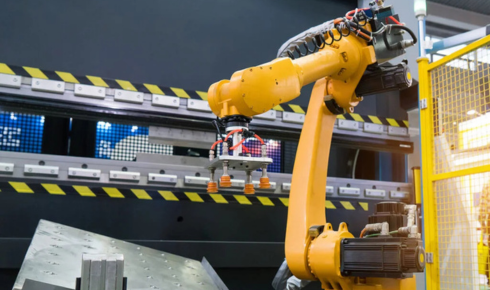

Heavy Machines for Projects

Construction, logistics, and mining companies rely on heavy machines. These machines are often large, costly, and require expert handling. But without them, deadlines get missed, and manpower costs go up. Buying such tools outright is not possible for many contractors.

Capstone offers machinery funding for heavy equipment. These loans help companies buy the right tool for the job without delay. The company supports both movable and immovable machinery, which gives more options to clients.

The right machines help your business work faster, serve more customers, and grow. But big machines cost money. That’s why many MSMEs turn to machinery funding from Capstone. You can finance machines made in India or from abroad. You can also get support for medical tools and heavy project equipment.

If you’re short on types of working capital or don’t want to risk your property, an unsecured business loan for MSME is a smart choice.

Keep your types of working capital free for day-to-day work, and let Capstone handle your equipment needs.